Risk management as a service

IP.RISK

Our integrated risk management approach guarantees you an up-to-date view of the risks in your portfolio. By using highly professional instruments, we provide detailed analysis for comprehensive control and monitoring of the risk structure of the investment fund in accordance with relevant regulations.

IP.Risk supports you in your daily work with the following service modules:

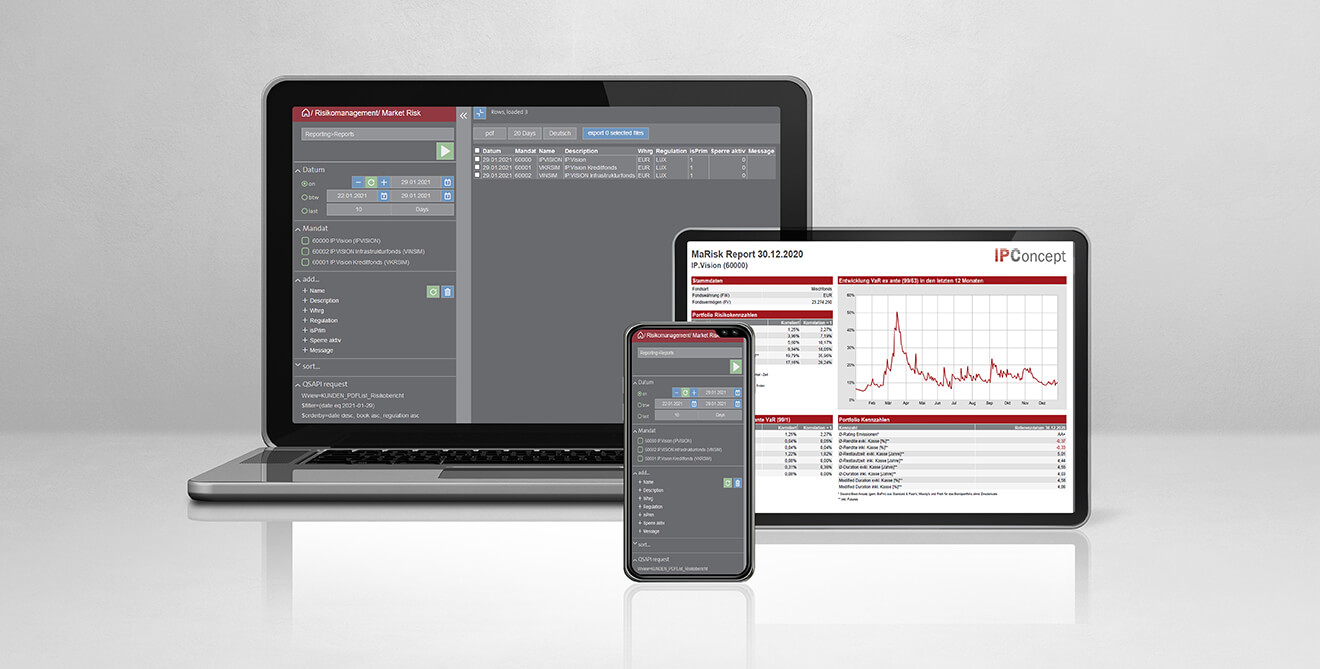

You can conveniently access your desired risk reports online with just a few clicks using our web-based application IP.Risk. Our IP.Risk API is available for structured data access. Our own risk management system allows us to respond flexibly and individually to your needs – for your fund or your ManCo.

The advantages are abundantly clear:

We’re pleased to offer you our competent and reliable advice.

Claudia Mogg

Head of Business Development

Tel: +352 260248-4865

Claudia.Mogg@dz-privatbank.com

Walter Forster

Business Development Switzerland

Tel: +41 4422-432-09

Walter.Forster@ipconcept.com

„Full service in CH, LU, DE – nobody comes even close to imitating us.“